36+ Usda home loan how much can i borrow

The usual rule of thumb is that you can afford a mortgage two to 25 times your income. Many CRE investors use the cash to either make improvements to the property or buy new Investment properties.

This Fact Sheet Provides A Step By Step Approach To Starting Your Agritourism Business Agritourism Agritourism Farms How To Memorize Things

The mortgage rehab loan can also be used to finance home improvements on current property.

. Homebuyers qualifying for a mortgage for a higher-priced home can borrow more with 2022 conforming loan limits increasing to 647200 for most parts of the country. This provides a rough estimate of how much you can borrow for a loan. Mortgage pre-qualification is an informal estimate of how much money you can borrow for a home loan.

If youre deciding to relocate between two areas it makes sense to compare loan limits to know how much you can borrow. It usually takes just one to three days and can be done online or over the phone. One of the first questions you ask when you want to buy a home is how much house can I afford.

VA and USDA home loans dont require a down payment. At 60000 thats a 120000 to 150000 mortgage. For example you probably cant pay 400000 for a home upfront however maybe you can afford to pay 30000 upfront.

Here are the current minimum conventional home loan requirements. With a 60-month term 10000. 3311 Data from Freddie Mac HUD and Mortgage Bankers Association.

How Much Mortgage Can I Afford if My Income Is 60000. Qualifying can be easier if you can buy a home farther away from the city. Apply for a Smaller Home Loan.

VA and USDA home loans dont require. Calculate the monthly payments total interest and amortization over 30 years at a rate of 3 to 55 when financing a 100000 home. This bank gets to keep the difference of 523.

Current minimum mortgage requirements for conventional loans. With a 72-month term 15000. 620 for manual underwriting but processing is longer.

Express loans are a great choice for self-employed applicants who need to access cash quickly as the SBA responds to Express loan applications within 36 hours of receipt. Should Ideally be 36. VA loans also have the advantage of limited closing costs and no private mortgage insurance PMI.

Down payments can range from 3 to 5 for a conventional loan and start at 35 for an FHA home loan. With a 100000 salary you have a shot at. A 100K salary puts you in a good position to buy a home.

How the Loan Works. As the VA guarantees a portion of the loan lenders can provide better terms including 100 financing and lower interest rates. Section 245a Graduated Payment Program.

VA home loans are provided by banks and mortgage companies. Its a good indicator of whether you satisfy minimum requirements to qualify for. With a cash-out refinance on a commercial property loan you borrow more money than you currently owe and get the difference between the two loan amounts in cash.

And with an 84-month term 20000. For example banks borrow from people who put money in a savings account at 007 and then lend out that money as a 30-year mortgage at 53. A mortgage would allow you to make that 30000 payment while a lender gives.

When you obtain a government-backed mortgage such as an FHA or USDA loan youre required to pay mortgage insurance premium MIP. With a 48-month term 7500. You can borrow money tax-free with a cash-out refinance.

For example with a 36-month term you can borrow as little as 500.

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

What Credit Score Is Needed To Buy A Car Credit Score Credit Repair Business Credit Repair

How To Get Started With Flipping Houses Flipping Houses House Flipping Business Property Flipping

It Is Possible To Increase Credit Score Quickly Here Are Some Credit Card Tips On How To Improve And Improve Credit Improve Credit Score Credit Repair Letters

Pin By Heather C On Credit Credit Repair Business Improve Credit Improve Credit Score

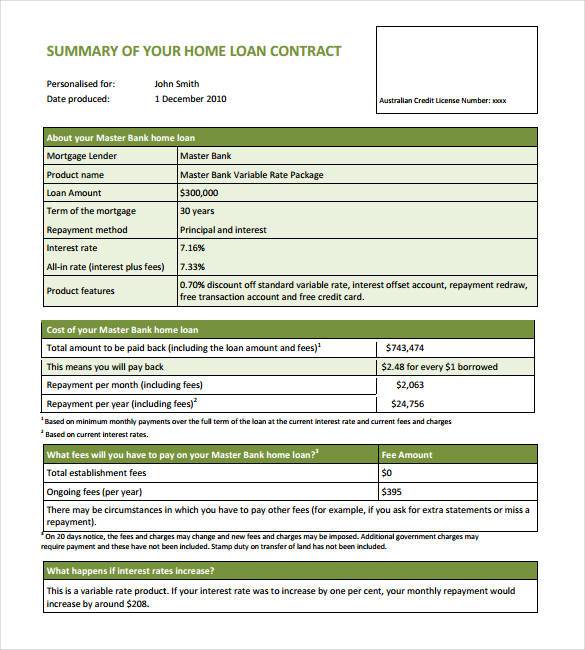

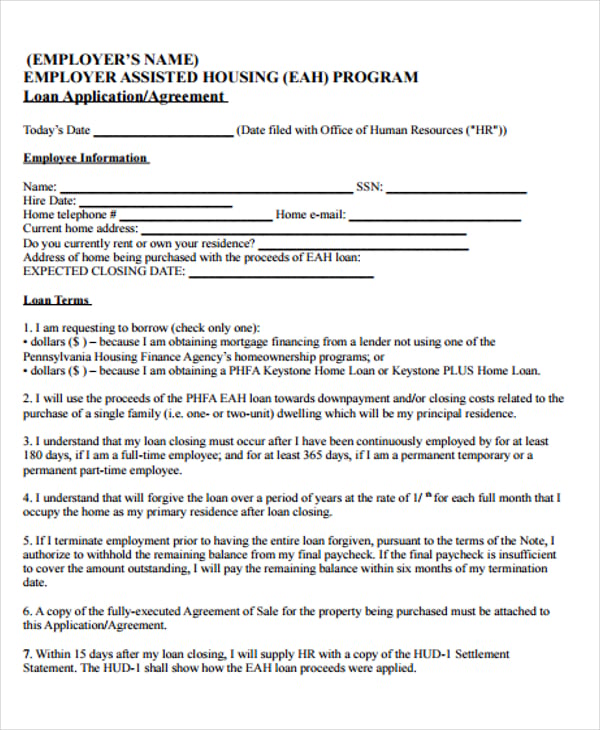

27 Loan Contract Templates Word Google Docs Apple Pages Free Premium Templates

How To Finance Building Your Homestead Homestead Hustle How To Buy Land Construction Loans Homesteading

Kentucky Usda Loans Rural Housing Loans Kentucky Mortgage Loans Home Buying Process Home Buying

25 Loan Agreement Form Templates Word Pdf Pages Free Premium Templates

Pin By Anseth Richards On Farm Loans Farm Loan The Borrowers Borrow Money

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2018 Fha V Fha Loans Conventional Loan Mortgage Loans

How To Fix An Error On Your Credit Report A Guide Credit Repair Credit Report Credit Repair Diy

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Credit Score Chart Credit Score Ranges Experian Equifax Transunion Fico By Www Creditsesame Credit Score Chart Credit Score Range Good Credit Score

Investing Calculator Borrow Money

I Have A Question For You What Zone Are You In In Order To Repair Improve Or Build You Have To K Credit Score Chart Credit Repair Business Credit Score Range

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic