Credit card repayment formula

Research shows that carrying debt can be bad for our physical and mental health. Below is a sample repayment schedule.

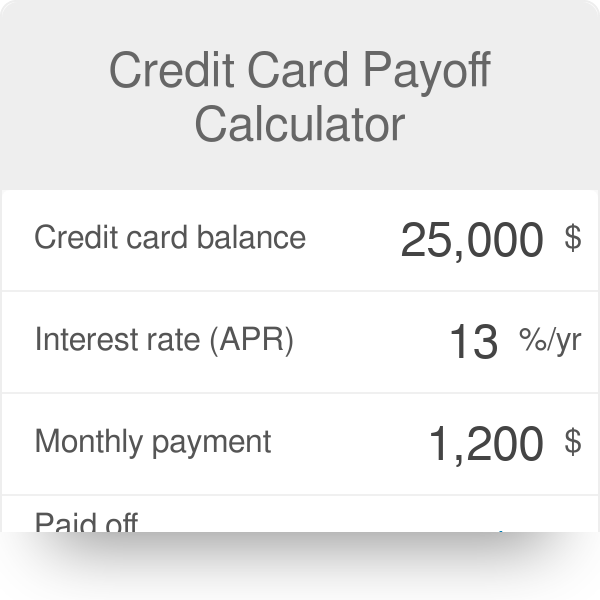

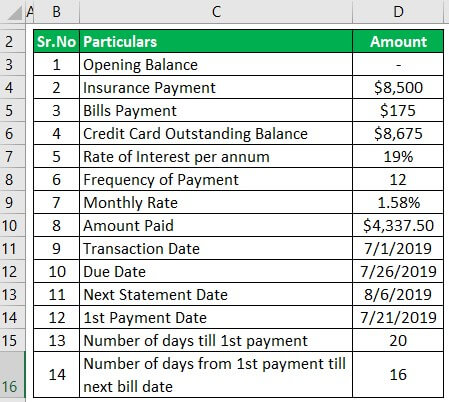

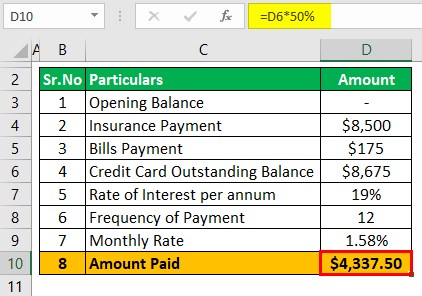

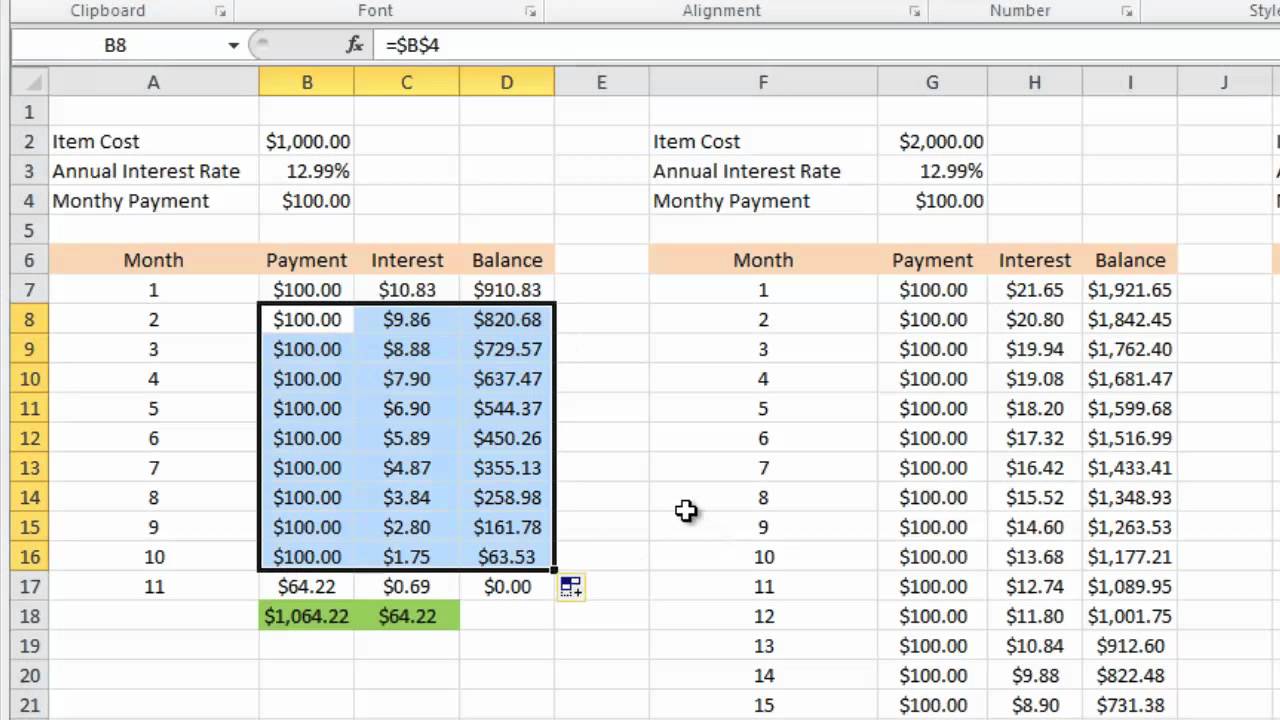

Credit Card Payoff Calculator

When you apply for credit lenders evaluate your DTI to help determine the risk associated with you taking.

. Credit Cards Other Credit Card Services Loans Financing. Figure out potential repayment schemes for your dream property using the Property Loan Repayment Calculator of CIMB SG. Use these credit card repayment calculators to work out effective strategies to pay off your credit card debt.

In case of errors in your credit report get it rectified at the earliest from the credit. Principal Amount x 1Converted Monthly Factor Rate x Term. The resulting score is commonly called a FICO score after Fair Isaac.

Reduce your excessive dependency on credit and try to reduce your credit utilization ratio especially if you max out your credit card limit regularly. A credit card installment plan can be an ideal payment option for you if you want to make a big purchase without paying for the entire cost in one go. Convert your big purchases into easy installments using Citi Credit Card at affordable interest rates.

By the end of your mortgage term usually 25 to 30 years you will have repaid everything and own your house outright. Revolving credit is a type of credit that does not have a fixed. Monthly Installment Due or MID using the following formula.

Repayment of a revolving loan is achieved either by scheduled reductions in the total amount of. Pre-approval can help you understand whether you qualify for a credit card without involving a hard inquiry. If you own real estate and are considering making extra mortgage payments the early mortgage payoff calculator below could be helpful in determining how much youll need to pay and when to meet a certain financial goal.

Plus the sooner you pay off your credit card debt the sooner you can focus on saving for retirement and other financial goals. Online in person over the phone or by mail. Your personal credit score is generated by a mathematical formula using information in your credit report.

Submit your credit card application. If you qualify youll preview multiple Universal Credit loan offers with different amounts rates and repayment terms. Credit scoring was first developed in 1958 by Fair Isaac Corporation to help predict whether a borrower will repay their loan on time.

Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. NerdWallet helps you compare bad-credit personal loans from lenders that accept borrowers with bad fair or thin credit. The Income-Based Repayment Plan one of four debt-relief programs instituted by the federal government might be the most attractive choice for the 69 of graduates in the Class of 2020 who took out student loans.

From the latest gadgets flyer miles dining and shopping deals to even waived fees you can get the most out of your points with Security Bank credit card rewards. A borrower must. There may be several options when you apply.

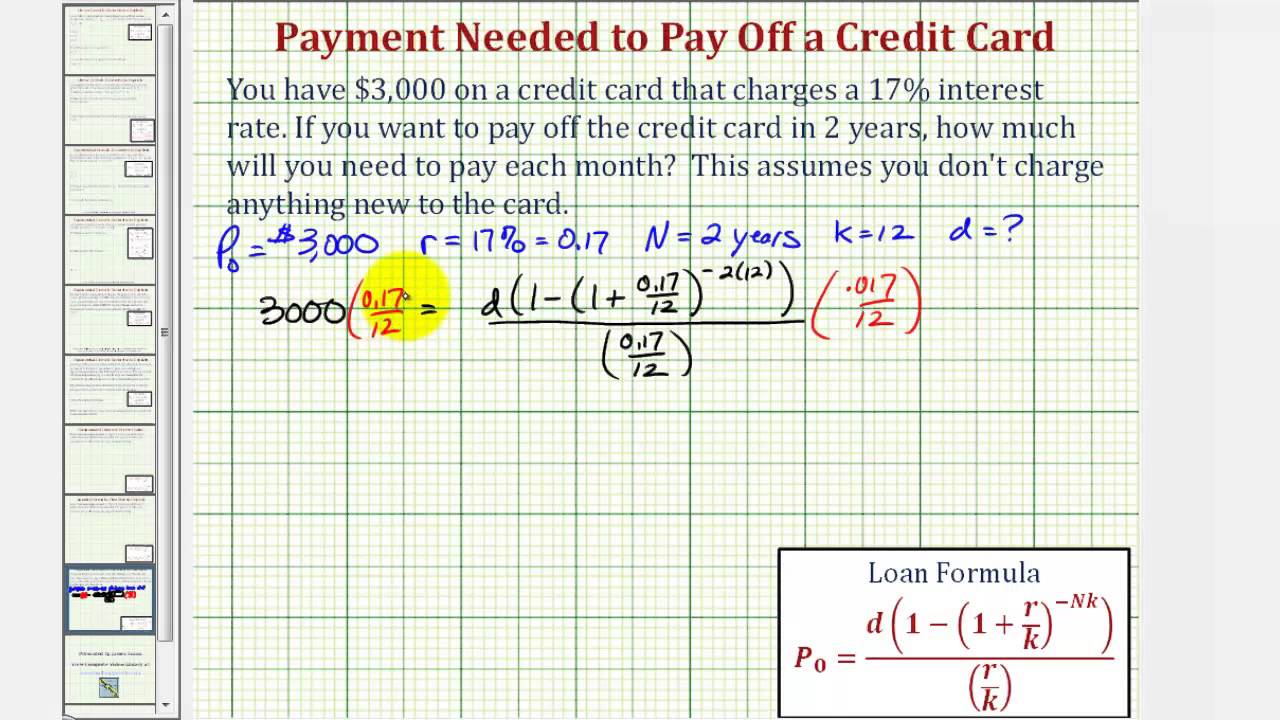

Credit Card Rewards is a program that allows you to accumulate reward points whenever you use your Security Bank credit card and convert them into exciting products or deals. Keep in mind though theres not always a simple formula for getting approved by a major credit card issuer says Jeanne Kelly credit expert author speaker and owner of credit coaching company. They typically use a formula to calculate your minimum monthly payment based on your total balance.

Determine how your credit card payments will fit into your budget. A minimum payment on the credit card would mean that what is the bare minimum amount that one would be obligated contractually to pay each billing cycle Billing Cycle The billing cycle is the time period between one billing statement and the. L is the Late fees charges.

Credit card loans and overdrafts are revolving loans also called evergreen loan. Find your bad-credit loan today. An annual percentage rate APR is the annual rate charged for borrowing or earned through an investment and is expressed as a percentage that represents the actual.

A credit card is a payment card issued to users cardholders to enable the cardholder to pay a merchant for goods and services based on the cardholders accrued debt ie promise to the card issuer to pay them for the amounts plus the other agreed charges. With a repayment mortgage you pay back some of the principal debt every month. Create a repayment strategy.

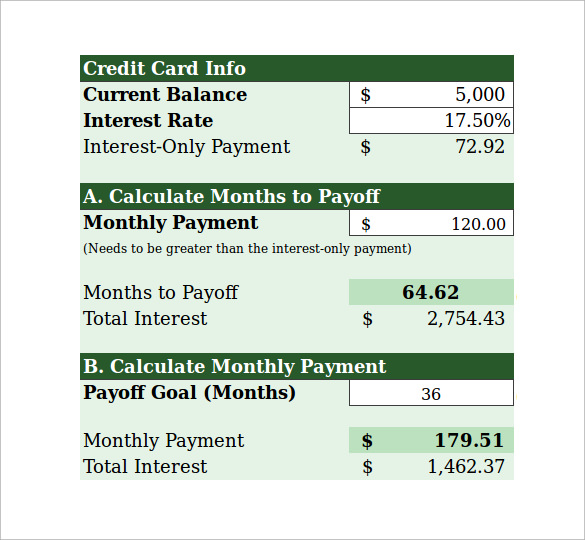

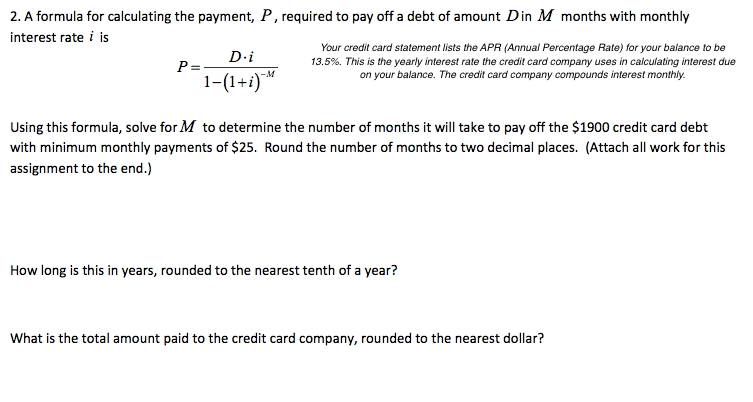

Paying off your credit card debt will lower your stress levels significantly. Calculate how long it will take to pay off your credit card balanceAlternatively use the second calculator to work out how much you should pay each month to eliminate your credit card balance completely in a set period of time. P is the percentage or rate.

For example most FICO Credit Scores range from 300-850 based on your credit history and can be viewed as a summary of your credit report. In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial healthCalculating your DTI may help you determine how comfortable you are with your current debt and also decide whether applying for credit is the right choice for you. Why Credit Card APRs Are Rising Despite Feds Third Rate Cut of 2019 November 4 2019.

For example if you wish to buy a laptop that costs PHP 40000 then instead of purchasing it by paying the total cost upfront you can charge the same amount to your credit card and pay for it. A is the total amount spent in a billing cycle. Start paying your loan EMIs and credit card bills on time.

CITI PAYLITE AFTER PURCHASE REPAYMENT SCHEDULE. Annual Percentage Rate - APR. There are assumptions projections limitations and difficulties in using any graph chart formula or other devices to determine mortgage.

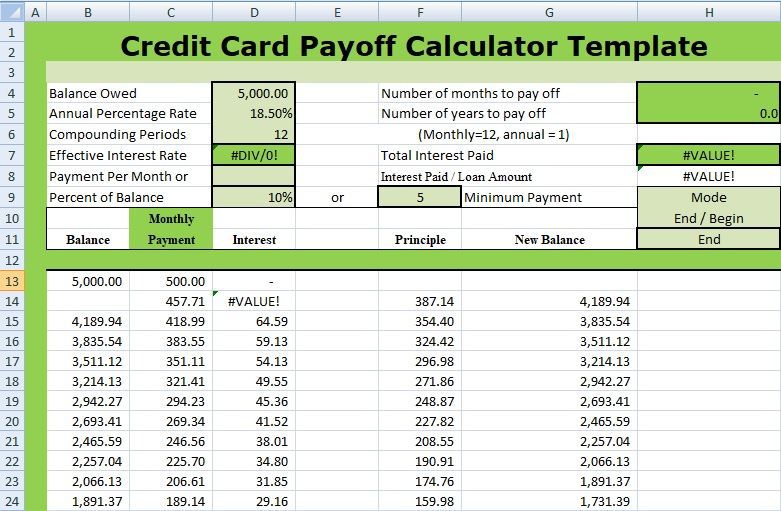

Credit cards also use fairly simple math but determining your balance takes more effort because it constantly fluctuates and lenders charge different rates. A credit score helps lenders evaluate your credit profile and influences the credit thats available to you including loan and credit card approvals interest rates credit limits and more. Do not miss payments under any circumstances.

I is the Interest if any applicable. And redrawn again in any manner and any number of times until the arrangement expires. The card issuer usually a bank or credit union creates a revolving account and grants a line of credit to the cardholder.

Once you accept an offer youll submit a formal personal loan application. Credit Card Payment Calculations. Paying off credit card debt isnt just a smart financial move.

For example your card issuer might require that you.

Credit Card Payment Calculator Sale Online 54 Off Www Wtashows Com

Credit Card Payoff Calculator Excel And Google Sheets Free Download

Free 9 Sample Credit Card Payment Calculator Templates In Excel

Credit Card Debt Payoff Spreadsheet Excel Templates

Math Monday The Cost Of Minimum Payments Blog

Ex Determine A Monthly Payment Needed To Pay Off A Credit Card Youtube

Credit Card Payment Calculator Sale Online 54 Off Www Wtashows Com

Credit Card Interest Calculator Calculate Monthly Interest Levied

Credit Card Interest Calculator Calculate Monthly Interest Levied

Calculating Credit Card Payments In Excel 2010 Youtube

Credit Card Math

5 Ways To Calculate Credit Card Interest Wikihow

Credit Card Payment Calculator Sale Online 54 Off Www Wtashows Com

Solved 2 A Formula For Calculating The Payment P Required Chegg Com

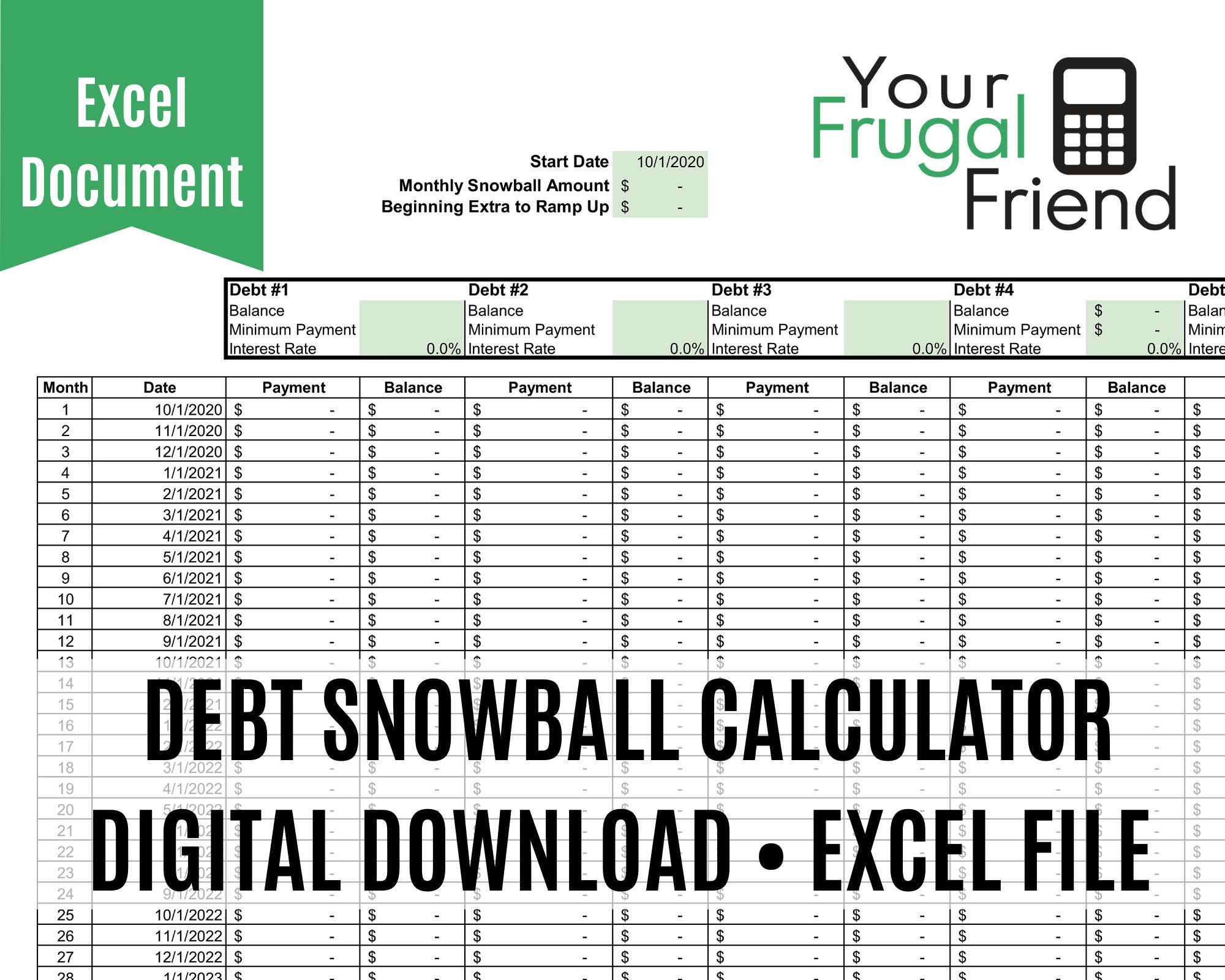

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy

Credit Card Payment Calculator Sale Online 54 Off Www Wtashows Com

Credit Card Math